When a Competitor Becomes Your Best Partner

Strategic partnerships with competitors: when rivalry becomes a growth lever. Learn how companies design competitor partnerships as part of their business model to reduce costs, share risks, enter new markets, and unlock growth.

Sergei Andriiashkin

Founder and Strategy Partner

Partnerships

/

Jan 28, 2026

The idea of partnering with a competitor sounds almost like an oxymoron. From an early age, we are taught that a competitor is someone you must beat, push out, or defeat. In real business, however, things are more nuanced. At certain stages of growth, a competitor can become the most logical and powerful partner — if you clearly understand the problem you are solving together. This is not about “friendship” or compromise; it is about deliberately designing a business model in which competition and partnership coexist at different levels.

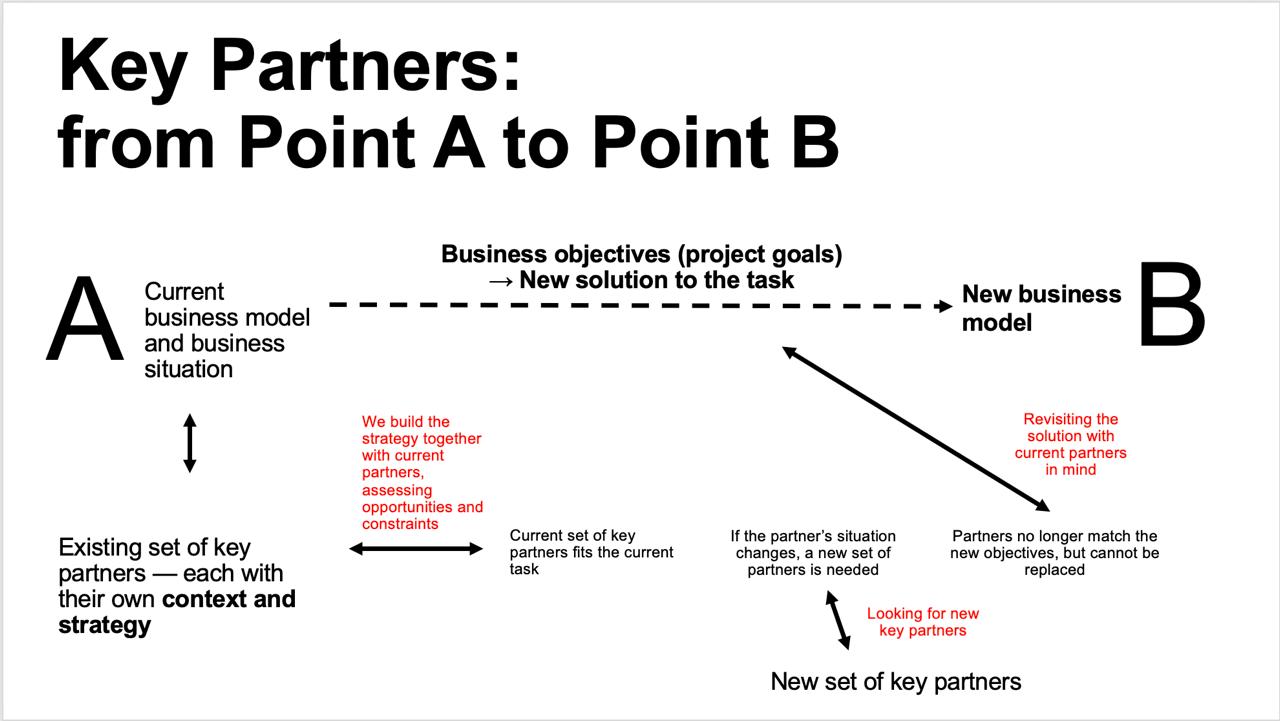

In the logic of strategic partnerships, competitors represent one of the possible types of key partners. Such partnerships can serve very different purposes: reducing costs, sharing investment risks, accelerating technology adoption, or developing a market — while remaining competitors where competition actually creates value. In some cases, partnering with a strong player is also a way to manage their market entry: integrating them into the model can be more effective than confronting them head-on.

A classic example comes from Scandinavian telecom. Tele2, Telia, and Telenor competed fiercely for customers, pricing, marketing, and service quality, yet collaborated on building 3G and 4G networks. The reason was straightforward: next-generation networks require massive CAPEX, and duplicating infrastructure undermines the economics for all players. Competition remained where it mattered to customers, while partnership emerged where redundant investment offered no strategic advantage.

A similar logic applies in the automotive industry. Toyota and BMW — direct competitors — jointly developed a sports car platform used for the Toyota GR Supra and BMW Z4, sharing R&D costs while preserving distinct products and brands. At the same time, they collaborate on hydrogen technologies: Toyota contributes its fuel cell expertise, while BMW accelerates market entry without building a full internal development cycle. This is not a retreat from competition, but a rational allocation of effort where the stakes are too high to play alone.

In some cases, partnering with a competitor is not about acceleration, but about market stabilization. In one regional real estate market, two developers had been aggressively competing for years, driving down margins and overheating the market. Eventually, it became clear that they were jointly destroying their own economics. Moving toward a partnership model — with clearer segmentation and focus — reduced pressure, preserved profitability, and allowed the market to develop more predictably. Competition formally remained, but it stopped being destructive.

There are also less obvious, yet very common scenarios. FMCG manufacturers that sell products under their own brands while also producing private labels for retailers effectively compete with themselves. In practice, however, they separate niches: the brand targets one audience, the private label another. As a result, manufacturers load capacity, reduce unit costs, and earn on volume without diluting positioning, while retailers gain margin and control. This is a partnership with a potential competitor built directly into the business model.

A more “ground-level” version of this logic appears when a large player handling complex, high-value projects becomes a key partner for a smaller, specialized firm. Formally, they are competitors; in reality, they operate on different levels of the game. The large player gains reliable execution and scalability, while the smaller one secures a steady flow of projects, client access, and growing expertise. For smaller businesses, such partnerships often become the core of the business model, enabling growth without heavy investment in aggressive marketing or sales.

The relationship between Pixar and Disney, described in Lawrence Levy’s book, deserves special attention. Pixar started as a key partner to Disney, but the contract that granted market access also imposed strict strategic constraints: a fixed number of films and an inability to work with other studios. As Pixar grew, it effectively became a competitor to Disney in animation — and yet it was precisely the disciplined management of this partnership that led not to rupture, but to the largest deal in the industry. Pixar became part of Disney while retaining autonomy, its team, and its culture. This is a clear example of how partnerships can evolve alongside business strategy.

All these cases share one thing in common: partnership here is not about relationships or rhetorical “win-win.” It is an engineered solution embedded in the business model, designed to remove a specific growth constraint — whether capital, technology, market access, scale, or resilience.

The risks are equally real: dependency, knowledge leakage, strengthening a future competitor, reputational consequences. That is why such partnerships cannot be built intuitively. The key question is not who stands against you, but which resource you cannot — or should not — build on your own.